In the last few years, there’s been a global movement to cut out third parties and build connections with consumers — largely through mobile-first apps like Instagram and largely driven by upstart fashion and packaged goods brands. This “direct to consumer,” or DTC movement, has resulted in an explosive amount of product choice, which by and large, has not delivered on the promise of better value by cutting out the retailer and a brick-and-mortar footprint. Anyone who has clicked on an Instagram ad for a $495 DTC t-shirt knows what we mean.

The pendulum has swung so far in the DTC camp, one could argue it really stands for “Difficult to Compare.” Consumers want choice; they need it to feel confident in their decisions. But — and this is important — they don’t want to waste their time and attention trying to understand the value of hundreds of options. That’s why they use retailers like Amazon and Alibaba that offer comparison charts, recommendation engines, and granular filtering. Imagine you went to the grocery store, and there were 500 types of mac-and-cheese products on the shelves — all different sizes, prices, and flavors. Talk about analysis paralysis.

The travel industry is the latest to adopt this DTC drive. And with good intentions: airlines want to own the end-to-end customer journey so they can use that data to refine their product offering and drive revenue. As the leaders in modern retailing, we are all leaned in on the industry’s digital transformation, and we are also aggressively innovating NDC solutions in a way that best supports all of our customers on the supply and demand sides (more on that later). However, for the industry’s digital transformation to be successful, we believe this drive cannot be at the cost of putting consumers first, or in our case, the traveler. Our role as a marketplace technology is to present our customers and their customers with confidence in the choices presented.

It is unrealistic to assume travelers will abide by a tax on their time and attention by trying to compare multiple versions of “premium economy,” infinite pairings of timings and price, and over 10,000 branded products from the world’s top 250 airlines. That’s not an exaggeration. In fact, our industry has gone from offering 500 products in 2010 to 10,000 in 2024, according to Travelport estimates. And as a result, today, travelers are visiting up to 277 webpages before booking a trip, compared to just 38 websites in 2013. We believe there is a better, easier, and more profitable way to manage and present multi-source content. After all, Jeff Bezos is somewhere on a yacht right now because he made it easy for consumers to compare apples to oranges in an apples-to-apples way.

Travelport recently conducted international research to provide insights on the end-traveler’s experience with NDC. The results show how overwhelmed customers feel when booking travel, due to a newfound proliferation of offers.

Here are our findings.

This is the question we’re hearing from travel agencies. Through NDC, some airlines are driving customers to owned channels and away from third parties like the GDS, travel agents, corporate booking tools, and OTAs. But it’s not just airlines moving customers towards buying direct. Hotels are drawing people away from comparison sites by investing heavily in loyalty programs, mobile app development, and by offering more personalized guest experiences, exclusive benefits and tiered rewards — not to mention incentivizing people with better rates. These campaigns have been very successful for brands like Hilton and Marriott in turning the tide back to direct bookings.

We mentioned earlier that one of DTC’s biggest draws is access to customer data. But airlines (and hotels) can already get that through their own websites. So, while NDC promises more in the way of personalization, our research revealed consumers do not feel that materializing for them. NDC can be perceived as a Trojan horse for DTC because customers do not feel it’s really about personalization. It appears to be more about giving airlines greater control of the indirect distribution channel, while also growing DTC. But this adds more layers to travel’s technical complexity challenge, making it even more complicated to buy for the end traveler.

Consumers don’t know what NDC is, or how it differs from EDIFACT. And they shouldn’t need to know this inside-baseball stuff either. Does it matter to you what kind of truck Amazon uses, or do you just want your parcel to arrive within 24 hours? Consumers care about things like prices, flight times, bags, Wi-Fi, and whether they get a free toothbrush — not the distribution mechanism. According to our research, today’s travelers are feeling overwhelmed:

say the number of choices (fares, bundles, brands) are overwhelming

Because NDC is implemented differently by every airline, the reality is the buyer is often forced to deal with NDC, whether they know it or not. To travelers, NDC looks like: different options available on different sites, seemingly arbitrary rules for flight changes, or random system incompatibilities. This does not feel like a modern retailing experience to the consumer. The same can be said for the travel agent’s experience, as they often see duplicated content on screen, or have to do extra technical work or open multiple tabs to compare products like-for-like. If you don’t have the right retailing technology, that is.

We should emphasize, not all airlines are doing this. Some are really using NDC to its full potential by offering consumers the same suite of products whether they buy direct or indirect. And even some LCCs that were most aggressively championing DTC are signing new agreements with agencies, as they want to be where the consumer is. But for the most part, while a lot of travel brands aim (and claim) to be customer centric, the reality feels very different for the traveler.

A few years ago, Travelport started a conversation about modern retailing. Our definition of it works backwards from the consumer’s needs, so we can help our agency customers deliver, all while driving yield for suppliers, too. But lately, this terminology has come to represent airline needs and distribution. IATA, for example, promotes NDC as the opportunity for airlines to become modern retailers, like Amazon.

Direct to Consumer (DTC)

IATA-led

NDC for airlines

One brand, several products

Cut out third parties (agencies)

Higher customer acquisition

Flight-centric

Apples-to-oranges comparison shopping

Investment in airline merchandizing

Hundreds of connections

Sell

Modern Retailing

Consumer-led

NDC for consumers

Multiple brands, multiple products

Benefit from the retailing power of agencies

Lower customer acquisition costs

The whole trip (air, car, hotel, rail)

Normalized, apples-to-apples comparison shopping

Investment in value-based retailing

One connection

Search, sell, service

But one brand selling and servicing only its own products is not representative of modern retailing, because best-in-class retailers offer the customers choices from multiple brands. The IATA approach overlooks the lack of standardization and considers servicing an after-thought. The end result? The current state of NDC makes the digital shopping experience even more cumbersome.

1

Simple side-by-side comparison helps consumers feel reassured about their final purchase. Our research shows almost 90% of travelers want to be able to see all their options on a single screen or website. For that reason, over half (54%) use a hybrid booking method: searching on a comparison site first before purchasing direct on the airline site.

2

Time and time again, consumers tell us that having choices is really important to them. That’s why DTC hasn’t killed off retailers, because people will always want options. So, making it impossible to compare apples to oranges is just making it a major inconvenience for shoppers, whether they’re business or leisure travelers.

3

Because NDC is being implemented inconsistently, customers wind up confused and frustrated when some changes can/can’t be made, depending on what fare type you booked. Compared to 10 years ago, 61% also recognize that there are more penalties for making a change despite using digital self-service platforms.

Travel is a high stakes purchase. Buying it should be fun at best and easy at minimum. Yes, even corporate travel. That means being transparent about cancellation costs, seat reservation policies, or whether you get a free toothbrush on a long-haul flight. Travelers worry about making mistakes when booking and being penalized for it. They want retailers to make changing a purchase much less of a big deal — after all, you get a cooling off period when you buy an iPhone, so why not a flight? Both can cost the same amount. This is a paramount issue for 50% of air travelers, yet 77% say it’s the hardest part of a trip to change. Some agencies already get how much this matters, like Hopper who now offers a ‘cancel for any reason’ policy.

As Galloway says, we can’t assume travelers will pay a tax on their time and attention by trying to compare multiple products. Modern retailing is about one thing: making it easier for them.

People don’t trust they’re seeing all the available options on go-to search tools like Skyscanner or Kayak. The same can be said for corporate booking tools, and this presents a whole other set of problems for travel management companies (TMCs). People need a more reassuring shopping experience, backed by easy UX design, to reduce that fear of missing out and regret. As we noted, nearly 90% want to see everything in one place — this is what helps build confidence and drives loyalty.

On the surface, DTC seems like a good cost-cutting measure. But if you dig a bit deeper, the expense really just shifts to other areas in the long run. Cutting out retailers means…

1

Brands don’t reach as many customers, especially business travelers, who are inclined to book through corporate booking tools.

2

Brands are overlooking the people who want to book a full trip in one place (e.g., package holidays) and so you lose that revenue stream.

3

Brands eventually pay a lot more for advertising, compared to the free promotion retailers offer.

Ten years ago, when DTC brands started to take off, customer acquisition through platforms like Facebook was cheap and scalable, enabling start-ups to build brand affinity and customer acquisition quickly and efficiently. That’s no longer the case. Nowadays, selling direct forces airlines to compete for customers on all the same media channels, driving acquisition costs up. This isn’t good for anyone. Between 2017 and 2022, the shift towards DTC has seen ad costs rise from $6 to $18 per 1000 impressions, while acquisition costs soared by 60% to ~$70, crushing margins.

In 2017, Nike bet big on DTC, slashing a number of retailing partners in an attempt to gain more control over its beloved brand. Despite initial success, the plan didn’t work out as its wholesale revenue started to slide, and, as CFO Matt Friend admitted, ‘it added complexity and inefficiency.” Nike’s DTC strategy failed Nike because it failed consumers, and underestimated the value wholesalers offer. Nike has since re-engaged its former retailing partners to balance out its DTC strategy. The lesson? Just (Don)’t Do It.

In this post-pandemic period, some other sellers who went hard on DTC have returned to selling via retailers like Amazon. Dollar Shave Club is a good example of this reintermediation. It started as DTC but eventually began selling through Walmart and Target once it was acquired by Unilever, due to the growing competitive landscape and investor desire to scale the business. In our industry, we’re already seeing that some airlines are changing tactics.

Some of you are probably thinking about how self-serving it is for a GDS to advise against a strictly DTC strategy, because you’ve seen headlines claiming NDC is the enemy of the GDS. But the fact is, there’s never been a greater need for an agnostic marketplace technology in travel, because there are more content sources than just EDIFACT and NDC out there now.

You could say we’re the ones standardizing the non-standard, making it easier to compare apples to oranges in a more user-friendly, apples to apples like way. We’re working hard with airlines around the world to help them enable NDC in a uniform, scalable, effective way. Our approach allows agents access to multi-source content all in one place, with innovative technology that makes comparisons fast and easy. And that means the current, fragmented, siloed customer experience that NDC has created can start to get a little better and perhaps deliver on its promise.

When too much choice is a bad thing, agencies and their customers need help curating and managing it. It’s interesting to note that, although hotel is a more emotive choice, people still find it more difficult to choose and compare flight options. Why? Because comparison is harder and the risks of getting it wrong can be higher. When asked how difficult flight policies and amenities are to compare vs. hotel, flights were found to be harder by a margin of 2:1, according to travelers. And as we saw earlier, people are spending over 4 hours on average to plan trips, which is quite certainly a tax on time and attention.

There’s been much talk about generative AI and what’s coming to the travel space. But already today, Travelport is using AI and machine learning to simplify the ever-growing complexities of multi-source content enabled by NDC.

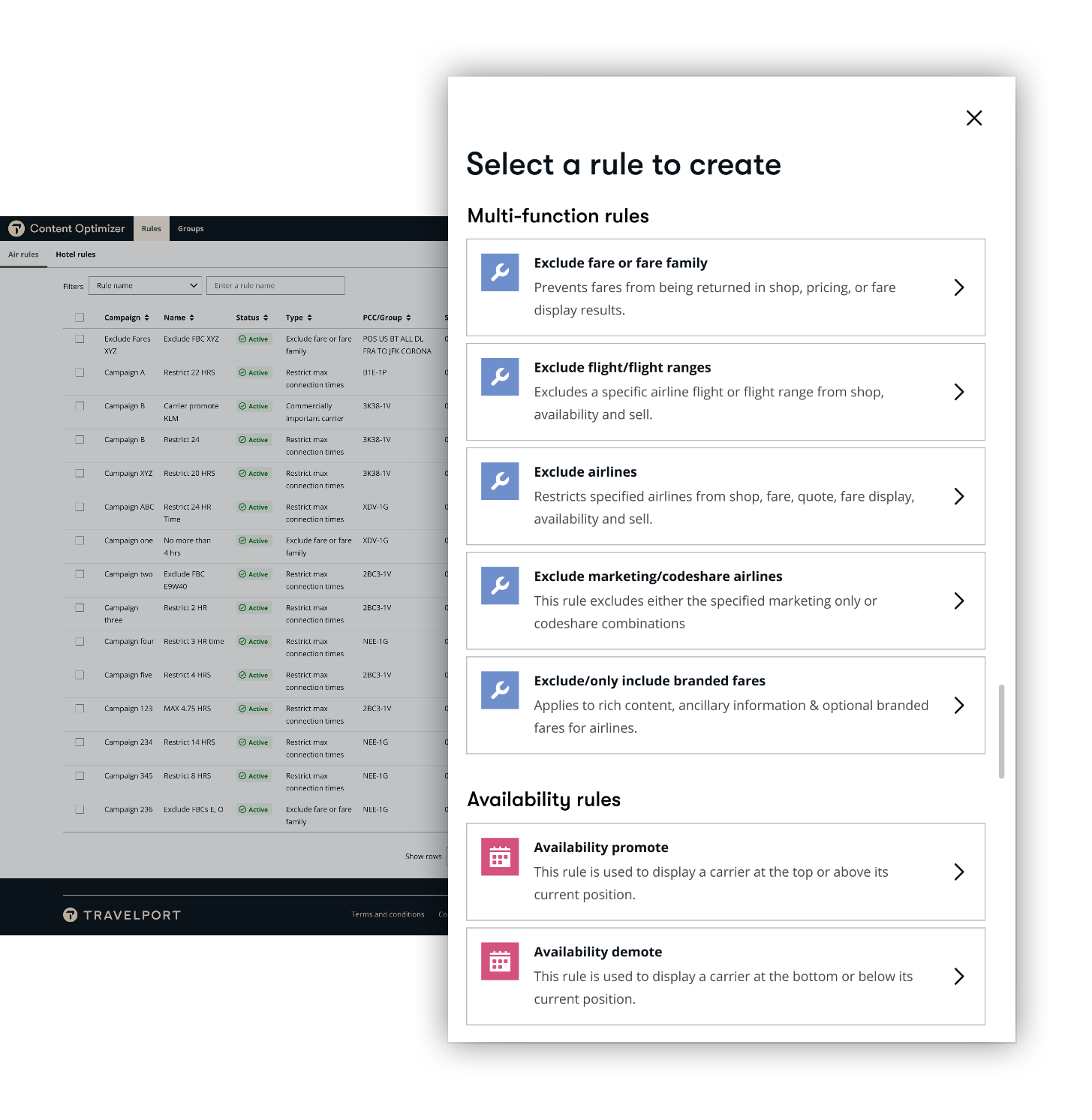

For agencies and travelers alike, the explosion of choice is causing on-screen clutter, slower searches, and confusion. But we can fix that. We’re doing that in part through our new Content Curation Layer and Content Optimizer, which help us strike a balance of controls and optimize for both demand and supply sides. This latest enhancement unlocks smarter, faster searches with clearer and more standardized results from all sources (Air, LCC, NDC, Ancillaries, Hotel, Car, Rail, Cruise), all in one powerful platform. That way, agents get more control, earn more, and automate more, through a user interface that’s clean, easy to use, and offers everyone a more valuable experience. This is the role of all marketplace technologies, from ad tech to fin tech to travel tech.

Nobody is saying suppliers should dismiss DTC (or NDC) as a distribution strategy. Far from it. It’s about striking the right balance and knowing how to get the best out of each and every channel. DTC can be part of your distribution strategy, but history has proved retailers aren’t going anywhere either. Armed with better tools, many are coming up with innovative ways to compete with direct sellers. OTAs like eDreams are changing their business model to be less transactional and build loyalty through a subscription model. Others have a unique value proposition like lastminute.com, or differentiate on customer demographic and emerging needs, like Hostelworld. At the end of the day, each brand can tweak its direct and indirect options to get the best results, all the while asking: how does this impact the consumer?

At Travelport we’re all in on NDC, and we continue to innovate ways to normalize and optimize multi-source content for both suppliers and agencies, all through the lens of the end traveler. This is how we help our customers help their customers. In the past few years, we’ve supported our supply side customers in all the ways they can retail. We know airlines and hotels are already great at selling in the direct channel — our mission is to support them in the indirect channel, too. We were the first to solve for their visual merchandizing and product comparison challenge when selling via agencies, which we’ve achieved through rich content and branding tools. We’re helping normalize and enrich their data, so it can be presented and viewed by agencies in that apples-to-oranges way. And, we’re continuing that with NDC, by partnering with IATA and airlines to support a faster, more consistent roll-out process.

We believe you can’t truly be pro-modern retailing and anti-comparison. Because modern retailing should benefit everyone, but let’s start by working backwards from the traveler. Remember: they just want a nice, easy shopping experience, choices they feel good about, and hey — didn’t someone mention a free toothbrush? Let’s give that to them (the experience, not the toothbrush). Offer them the right options, the information to help them made educated decisions, all wrapped up in a simpler, comparative experience. Modern is a better and more cost-effective approach to retailing, and one that brings the entire industry together.

Because when you put the customer first, everyone wins. Agencies, suppliers, and the traveler too.

Get the latest news

Want more insights like these? Sign up to our regular email.