Why Travelport Insights?

Destination Insights

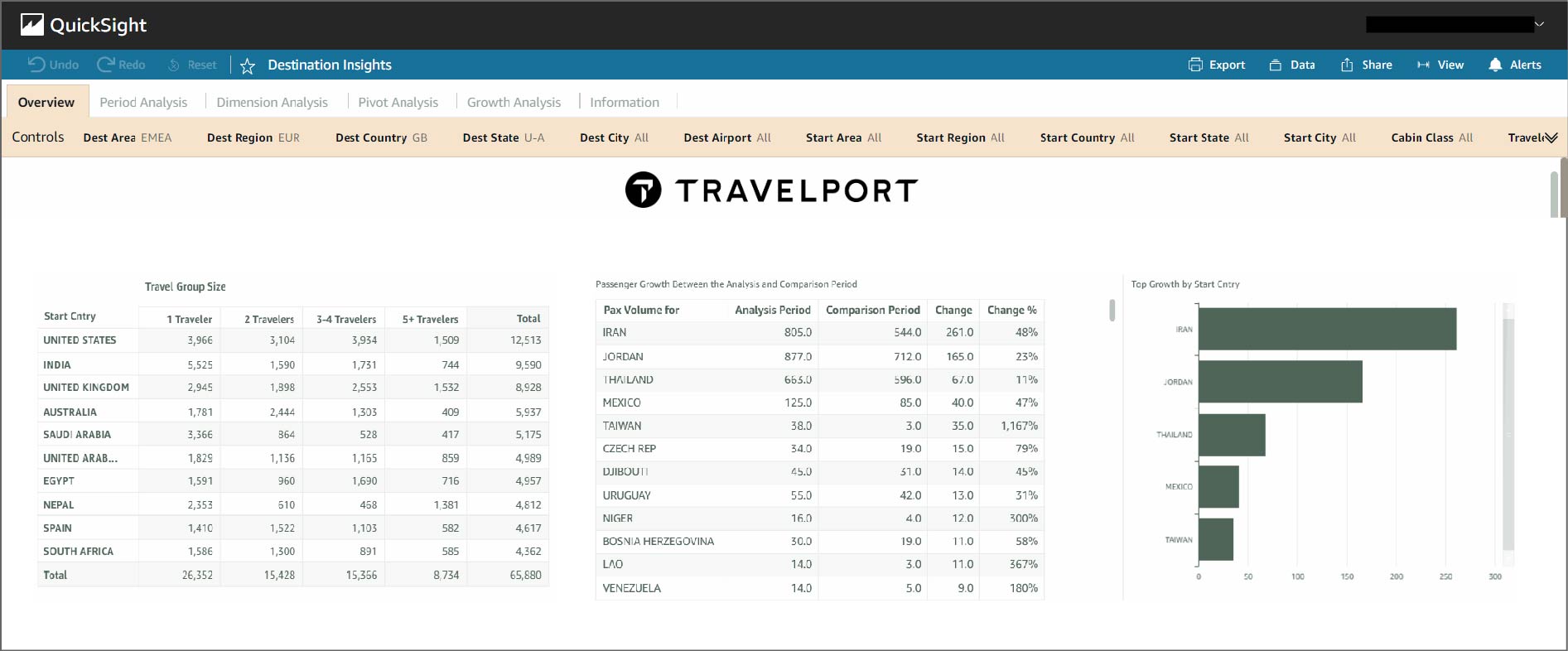

Designed for Destination Marketing Organizations, plus Hotel and Car suppliers. It offers more insight on where travelers are arriving from, what class they are traveling in, how far in advance they book, and whether they’re traveling alone, as a couple or as a group.

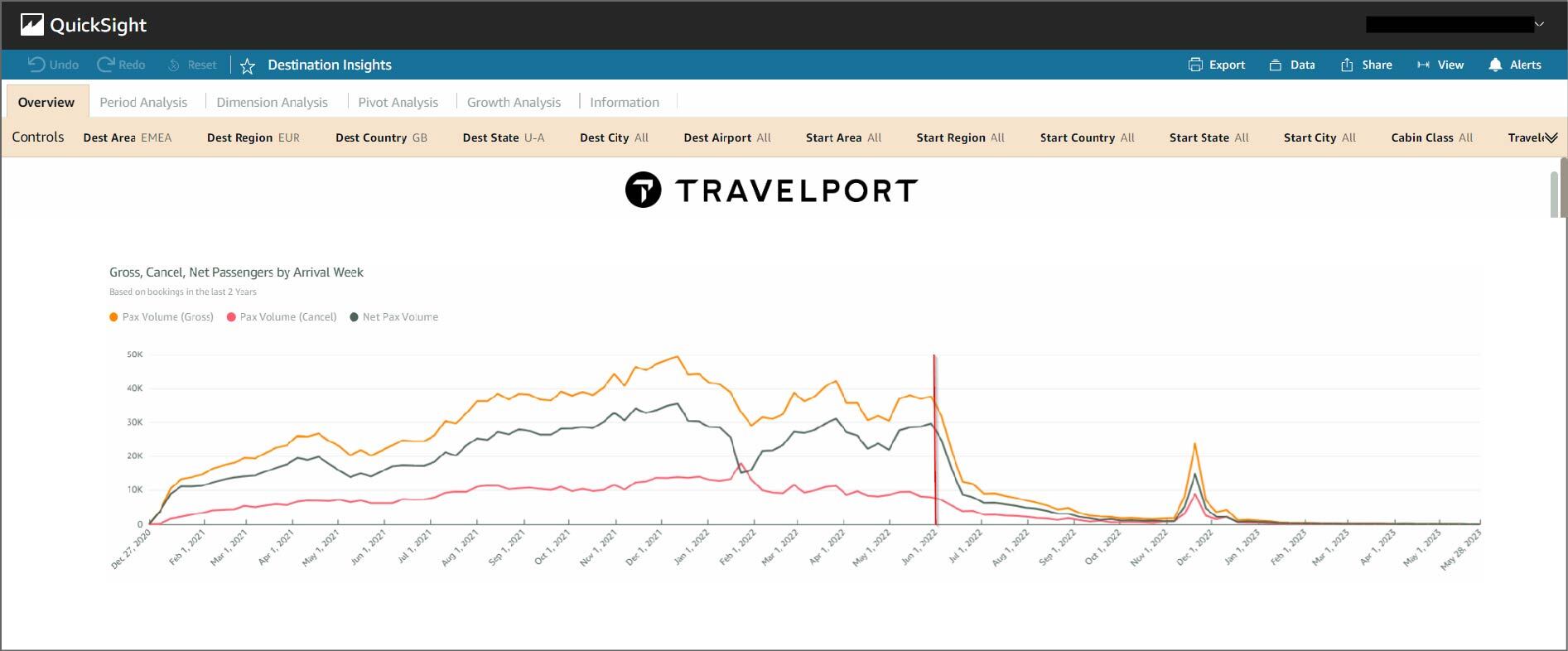

Destination Insights is a traveler analytics portal through the eyes of a destination.

Destination insights enables you to:

Visualize long-term future and historical demand, the understanding impact of cancellations on traveler volumes

Learn more about traveler demand by tabulating trip and traveler characteristics and respond to fluctuations in demand by focusing on areas of recent growth

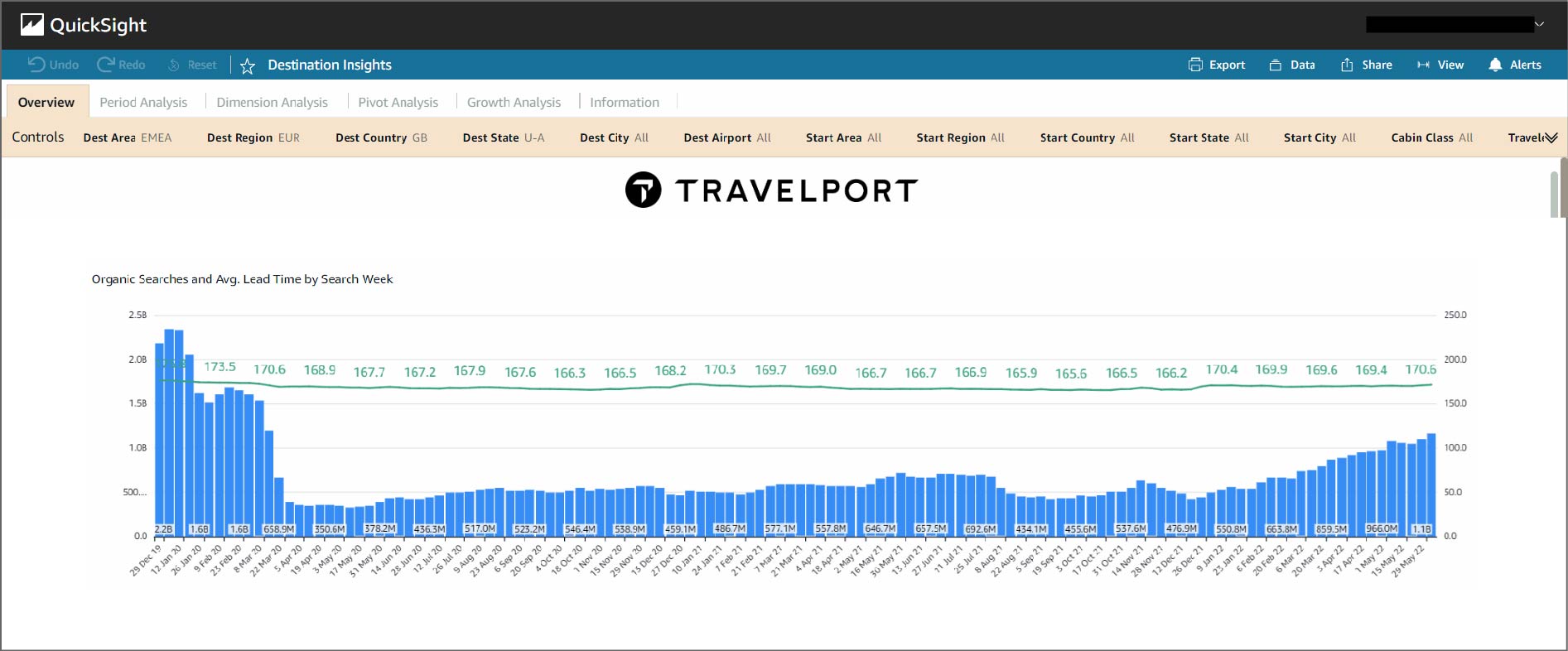

Air Search Insights

Our Air Search Insights is designed for Airlines, Destination Marketing Organizations, Hotel and Car suppliers. It provides intel on true traveler intent through a wealth of daily air search data,. Our daily air search data provides the ability to see traveler confidence returning as global travel restrictions continue to ease.

Users get access to a dashboard that removes robotic searches to present only the most valuable and accurate available data. And, you can find what you need quickly and easily though an intuitive self-service tool on the portal.

Air Search insights enables you to:

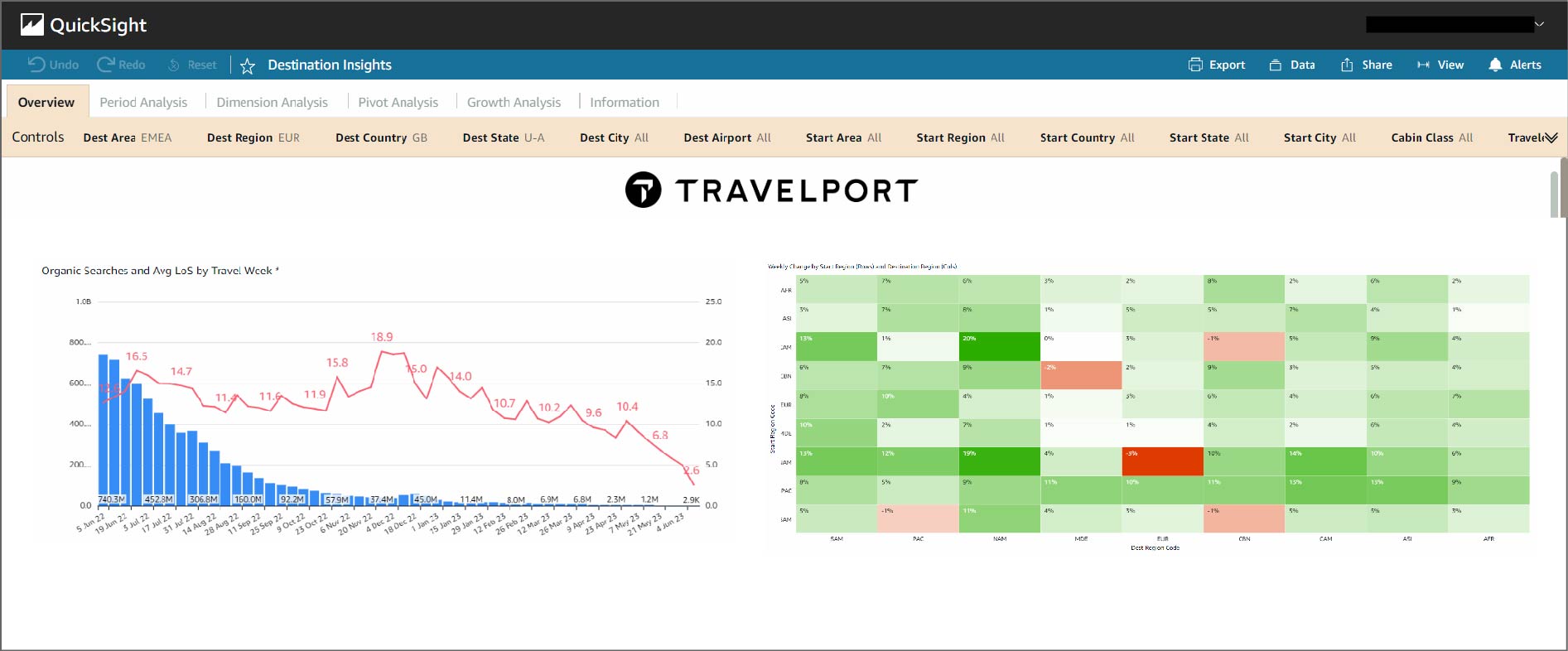

Access weekly search volume over time, with average lead time (days between search and travel dates)

See heat maps showing regional fluctuations in weekly shopping trends and intended travel periods

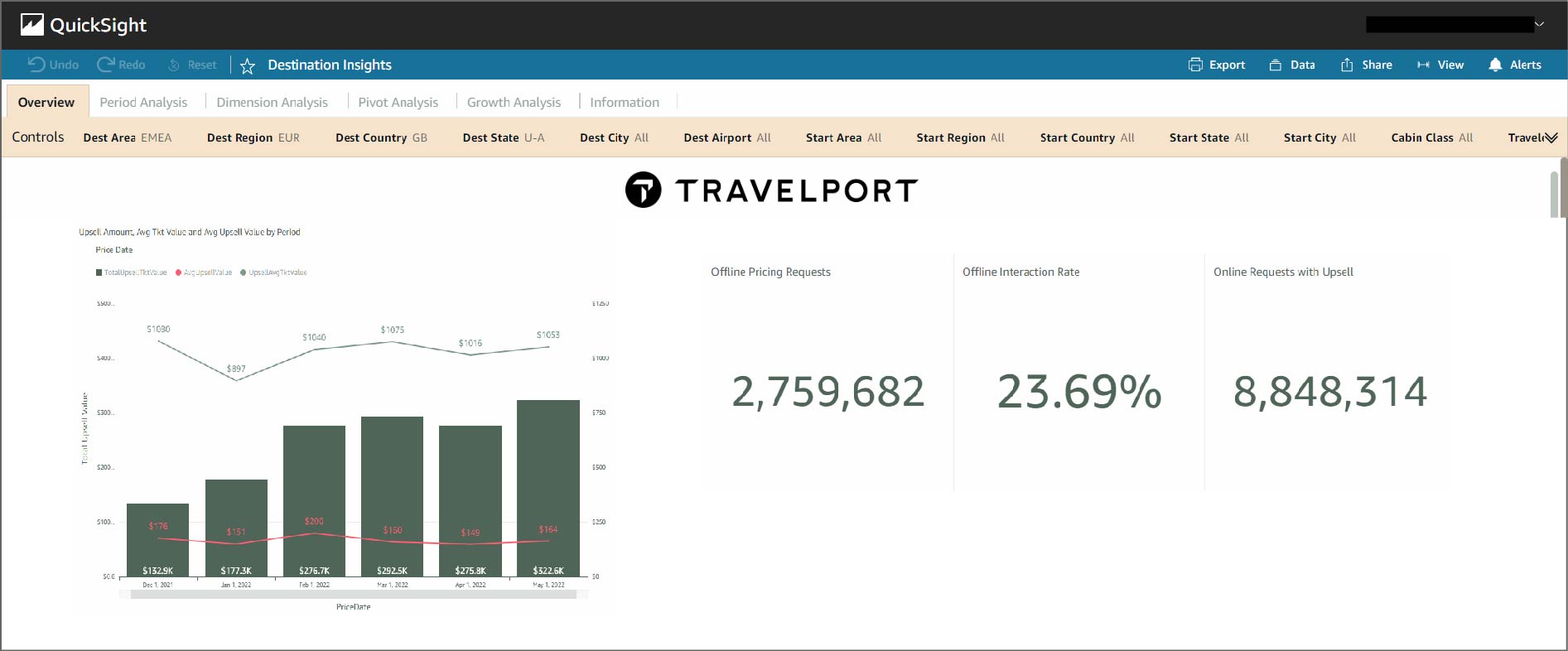

RC&B Airline Insights

Our RC&B Insights tool is designed for global and regional airlines, Low Cost Carriers and Airline Groups and Alliances. It provides comprehensive performance data on your airline’s products, so you can see when, where, and how RC&B upsell on these offers occurs. Users can compare an airline’s progress to a regional benchmark on an intuitive, self-service dashboard.

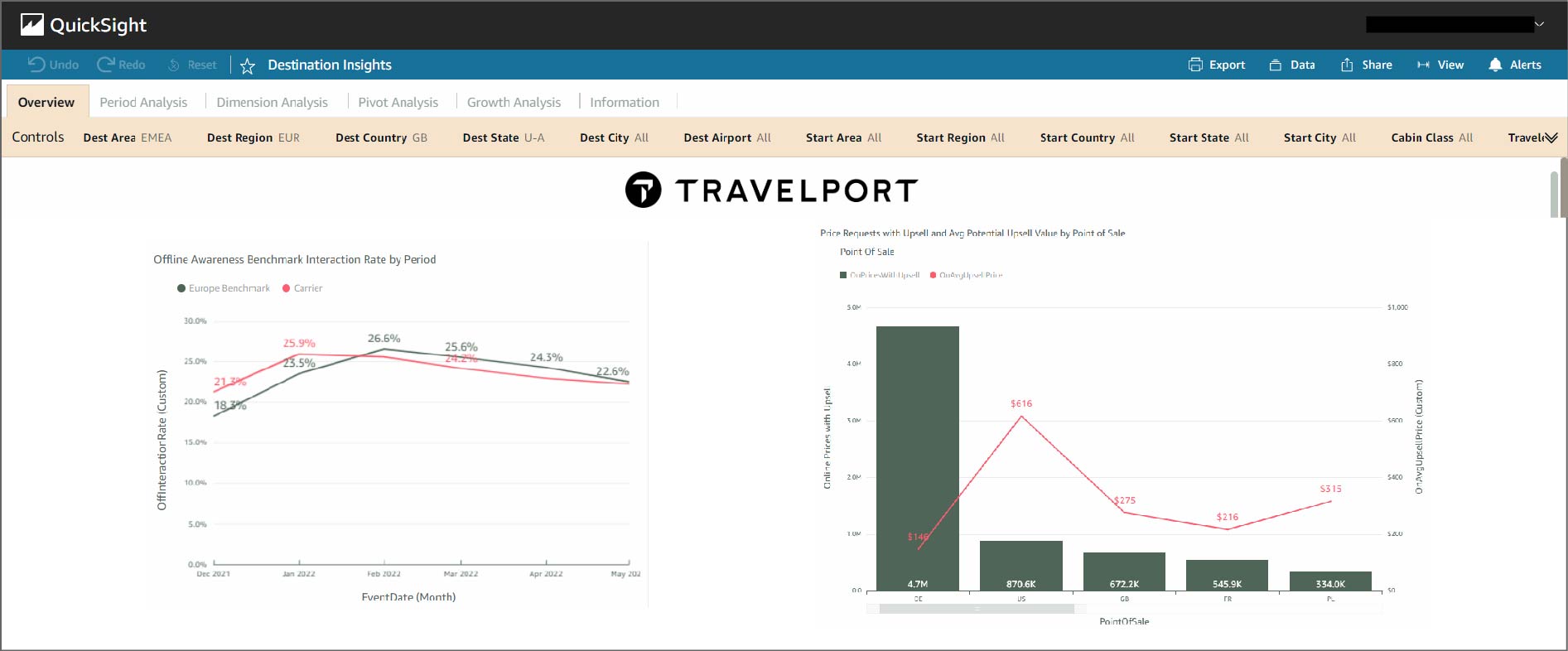

See RC&B interaction rate (how often RC&B is interacted with when RC&B content is presented to a travel agent) for a European carrier, as well as a European benchmark (average interaction rate for all European carriers). And Online search requests that returned RC&B content, split by country point of sale

RC&B upsell data (total revenue as a direct result of RC&B being used) by month and top level metrics; pricing requests for offline agents, offline interaction rate, and online search requests